Liquid Staking vs Liquid Restaking.

TL;DR.

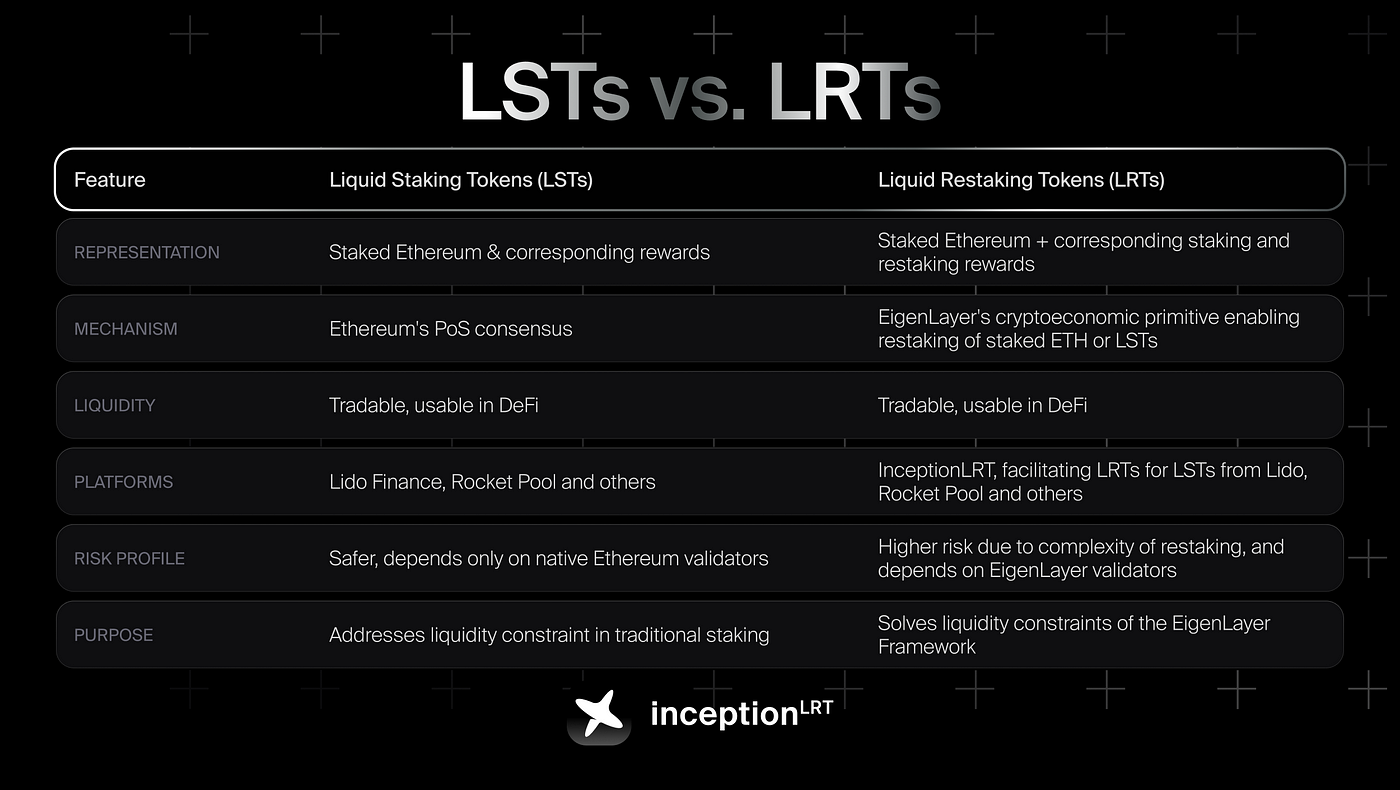

At the core of liquid restaking is the ability for liquid staking tokens (LSTs) not only to be staked but also tokenized into liquid restaking tokens (LRTs). These LRTs can then be used in a much broader spectrum of activities than simply increasing yield, as is the case with LSTs and liquid staking.

Liquid Staking and its newcomer, Liquid Restaking, are reshaping the landscape of DeFi, offering novel approaches to staking within blockchain networks.

Liquid Staking: The Evolution

The transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS), notably marked by Ethereum's Merge in September 2022, introduced validators as key players in transaction verification. Liquid Staking emerged, allowing users to stake cryptocurrencies like ETH and earn rewards without sacrificing liquidity.

Liquid Restaking: A New Dimension

EigenLayer pioneered Liquid Restaking in June 2023, presenting an innovative architectural shift. Unlike Liquid Staking, Liquid Restaking tokenizes staked assets into Liquid Restaking Tokens (LRTs), broadening their utility beyond yield enhancement. EigenLayer's Actively Validated Services (AVSs) enable restakers to participate in diverse DeFi activities, fortify networks, and engage in market-driven tasks [1].

Key Differences

Utility: Liquid Staking focuses on enhancing yield through tokenization of staked assets, while Liquid Restaking extends this concept by introducing LRTs for multifaceted DeFi engagements.

Integration: Liquid Staking protocols like Lido enable users to stake ETH and receive staked tokens in return, whereas Liquid Restaking protocols like EigenLayer integrate with Ethereum's consensus to facilitate AVSs, offering a broader range of functionalities .

Risks and Rewards

Slashing Risks: Both Liquid Staking and Liquid Restaking entail slashing risks, exposing staked assets to penalties triggered by validators' malicious behavior. However, Liquid Restaking introduces additional layers of risk due to its multifaceted nature.

Cascading Liquidation: Market fluctuations can significantly impact the value of derivative tokens in Liquid Staking protocols, potentially triggering cascading liquidations. Liquid Restaking compounds this risk by introducing more complex DeFi engagements.

Conclusion

Liquid Staking and Liquid Restaking represent significant advancements in DeFi, offering users diverse avenues for staking and engaging with blockchain networks. While both present lucrative opportunities, they come with inherent risks that users must carefully consider.