Ownership distribution in the ETF market - DD.

I've been looking for this date of myself for quite some time, and now we have it, and a big thank you to Sanjay, who dug it up!

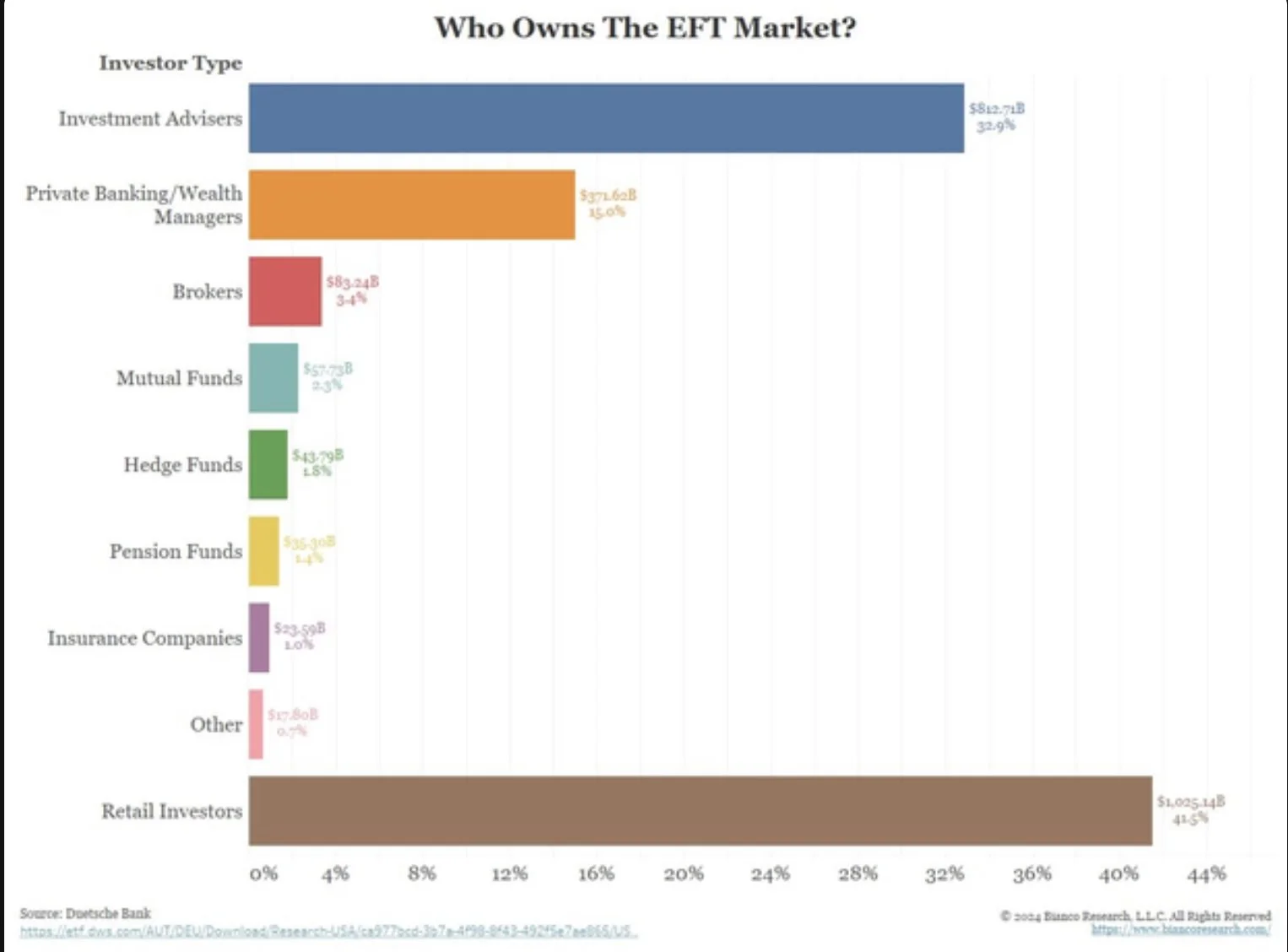

The chart shows the ownership distribution in the ETF market:

Retail Investors: 41.5% ($1,025.14B)

Investment Advisers: 32.9% ($812.71B)

Private Banking/Wealth Managers: 15.0% ($371.62B)

Brokers: 3.4% ($83.24B)

Mutual Funds: 2.3% ($57.73B)

Hedge Funds: 1.8% ($43.79B) [I see this growing a lot over the next few quarters.]

Pension Funds: 1.4% ($35.30B). [I see this growing a lot over the next few quarters.]

Insurance Companies: 1.0% ($23.59B)

Other: 0.7% ($17.80B)

Retail investors own the largest share, followed by investment advisers and private banking/wealth managers. The remaining ownership is distributed among various entities, each holding less than 4%.

Source: Deutsche Bank